One of the states that has traditionally gotten the least infrastructure love, at least in the media, is certainly New Mexico. With Tier 1 markets to the west in Phoenix, the north in Denver, and to the east in the DASH triangle, one rarely hears from Albuquerque and Santa Fe etc. But that doesn’t mean there isn’t fiber out there, and recently a new state-wide network operator was born: New Mexico Fiber LLC. Built from the combined assets of local RLECs and ISPs, NM Fiber is looking to take its case to the broader market. With us today to talk about the company’s plans is chairman Glenn Lovelace.

One of the states that has traditionally gotten the least infrastructure love, at least in the media, is certainly New Mexico. With Tier 1 markets to the west in Phoenix, the north in Denver, and to the east in the DASH triangle, one rarely hears from Albuquerque and Santa Fe etc. But that doesn’t mean there isn’t fiber out there, and recently a new state-wide network operator was born: New Mexico Fiber LLC. Built from the combined assets of local RLECs and ISPs, NM Fiber is looking to take its case to the broader market. With us today to talk about the company’s plans is chairman Glenn Lovelace.

TR: What are the origins of NM Fiber, and how did you get involved?

GL: I‘ve been involved in telephony for a long time now, longer than I care to admit — pre-divestiture with AT&T. For the last 16 years, I’ve been the CEO of Peñasco Valley Telecom, an independent telephone company in southeast New Mexico. We’re about 45 miles south of where the aliens landed in Roswell, just to give you a geographic reference. I have been involved with trying to establish New Mexico Fiber Network for about fifteen and a half years, but I have a friend that remembers that he first started trying to get this together in 1982. What has happened to make it come together now is mostly the NTIA grants, which is forcing states to focus more on broadband. It has obviously been really important to get broadband in rural America for a very long time, because the digital divide has been real and prominent for decades. But this effort is relatively new and was jump started from the pandemic, which brought everything to a head.

TR: Which grants in particular are you looking at, and how do you anticipate approaching them?

GL: There are two programs that are both managed by NTIA. The first is the Broadband Equity Access and Deployment (BEAD) program which is a $42.5 fund. The second is the Enabling Middle Mile Infrastructure Program which is a nearly $1 billion fund. Its’ window opens in June and it closes in September, and there are a lot of things that have to happen. It has catalyzed the independent rural telcos in New Mexico that have been thinking about creating a state network for a long time. It’s really hard to get all of us independent companies to agree on anything, it is a bit like herding cats. We started in earnest working on it again this time last September, and we finally signed off on our documents in March. We’re running pretty fast trying to catch up, putting all of our networks together so that we can work with the different state agencies in time to participate in the middle mile funding opportunity.

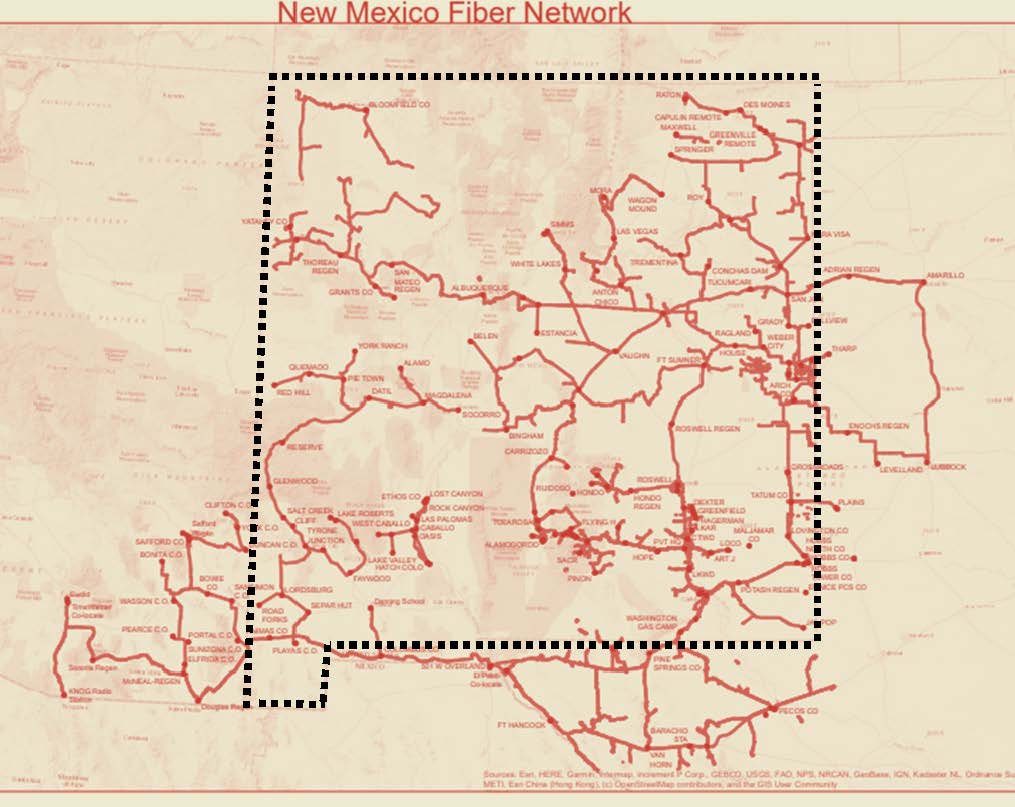

TR: What does NM Fiber’s infrastructure look like today?

GL: The combined fiber map for all 11 member companies is just over 10,000 route miles of fiber. We also interconnect with the Texas Lone Star Network, which is a group of about 40 telcos in Texas. We have also been accepted as a member of INDATEL which is a nationwide network that works with 37 state networks. This national footprint means we can now serve large carriers and major customers that we didn’t have access to previously. We are just getting off the ground, but we’re going to be working with a host of different state agencies and other entities, the Office of Broadband, the State Education Network, the Department of IT, Department of Transportation, Tribal networks, etc. We will interconnect with everybody we can. We’re going to sell Internet backhaul, and by combining our traffic we will all get lower costs.

TR: In your statewide fiber footprint I see a few islands. Will you be making any moves to connect more comprehensively?

GL: Absolutely. Most likely we will do a combination of building fiber, leasing, and buying fiber. But we have just begun the process of figuring out where we need to connect and where we need to ring parts of the network. If it’s not on a ring and the fiber gets cut, everyone on the other side of the cut is just down. With more rings, the network is much more reliable. The engineering has started and will happen fairly quickly.

TR: Other than seeking BEAD funding, what types of customers will you target initially?

GL: Just working within the 11 companies we’ll build a significant base, because we will be our own customers. Beyond that, via our access through INDATEL we can work with carriers on a national basis, and we will be able to take on more projects than we were able to individually. Many carriers don’t want to work with 1000 small telcos around the country, but they will work with nationwide carriers like INDATEL. We’re also having discussions with the state of New Mexico about how we can incorporate some of their interests into our business plan, such as which parts of the network they would like to use and what additional cities they would like us to connect.

TR: What parts of New Mexico do you foresee possible projects suitable for BEAD funding?

GL: In the northeast part of the state there are isolated areas with some tribal entities and disparate networks that are not well connected. I would think we that we could help to connect those as quickly as possible to make sure that everybody not only has fiber, but that it’s connected to the rest of the network for higher speed and lower cost access. There are a lot of places today that pay exorbitant prices for internet access, and once they are connected to the state network, we’ll be able to provide much better pricing to everybody, whether it’s a municipality, state agency, carrier, or a tribal entity. It is going to benefit all of us.

TR: So if you are successful in bidding for BEAD funding, how quickly will NM Fiber be able to move to build that new infrastructure.

GL: I think all of these are five-year programs. From what I’ve read, they expect to begin announcements probably in the first quarter of 2023. Realistically, with all of the programs that are coming out, it could be delayed by three months or more. I would be surprised if we hear anything back before mid-year of ’23. And after that there’s going to be a lot of paperwork, a lot of permits, and a lot of reviews before we can start building. So if we can start building by early 2024, I think that would be a great thing.

TR: How are you ramping up operations? Are you independently staffed yet or are you borrowing from your member companies?

GL: Right now we’re borrowing because we are just a few months old and we don’t have business on the network yet. But as soon as we have completed the network and are offering services through NM Fiber Network later this year that will change. We have already hired an engineering firm to help us with putting the network together as well as the grants.

TR: What is it like building fiber in New Mexico? How does it differ from other geographies?

GL: It’s not easy. New Mexico is mostly rock, not sand. We have a ten-foot rock saw that we use to bury our fiber at PVT, and our fiber has to go down almost four feet. With an entire crew and a full day’s work, sometimes we can go only 100 yards and sometimes we can go a mile. I have dreams of Missouri soil, where you have one team burying the fiber and four teams taking down fences and putting them back up, gaining five to twenty miles a day. We can’t do that here. The other issue is that we’re 45% state and federally-owned land, which means we have a lot of BLM and Forest Service land that we have to cross. With all of the impediments, it can take years and hundreds of thousands of dollars to clear the studies and get the necessary permits. That is very time, money, and labor intensive.

TR: What makes crossing federal land more time consuming?

GL: You can’t just get permission to go down I-25 or I-40 or cross state or BLM land. There are many, many hurdles. Typically we go through the permit process, we fill everything out, we send it in, and we hear back in six months to a year. And when we do hear back, there is usually a list of things that we need to do: environmental studies or geological studies, or other things. Generally it’s a lengthy and costly process. We completed one project recently at PVT where we had to spend $155,000 on studies for one permit. The land was already what they call “pre-disturbed”, meaning that it had already been analyzed and cleared. It usually requires a new study to be completed every time.

TR: NM Fiber has 11 founding members. Are there others out there you’d like to bring into the fold? Would there be electric co-ops and similar entities that might also be interested?

GL: We’re going to open it up shortly and take on associate members, and there are quite a few that are interested. I’m excited about that and I think they are as well. We’re not going to be an exclusive organization. We intend to interoperate with everyone we can. As for rural electric operators, there is at least one in New Mexico that I can think of that will probably be open to the possibility, and there probably will be more.

TR: Thank you for talking with Telecom Ramblings!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Industry Spotlight · Metro fiber

Discuss this Post