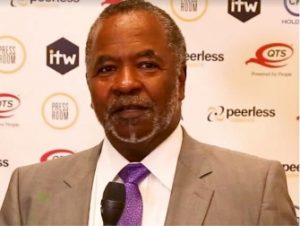

The world of submarine cables is currently very dynamic, and vendors supporting the various cable projects around the world are seeing new opportunities and taking on new technical challenges. In February of this year, H.I.G. Capital acquired the assets of Xtera Communications out of Chapter 11, and re-launched the company as Xtera. With us today to talk about the company’s new approach, the marketplace and its plans for the future is Chief Sales Officer Robert Richardson.

The world of submarine cables is currently very dynamic, and vendors supporting the various cable projects around the world are seeing new opportunities and taking on new technical challenges. In February of this year, H.I.G. Capital acquired the assets of Xtera Communications out of Chapter 11, and re-launched the company as Xtera. With us today to talk about the company’s new approach, the marketplace and its plans for the future is Chief Sales Officer Robert Richardson.

TR: How did today’s Xtera come to be?

RR: As you may recall, the former Xtera Communications filed for Chapter 11 in November of 2016. The old company had actually completed an IPO in November 2015. When they initially went to start the process, their goal was to raise $80-100M but only raised $21 million. That was not nearly enough to sustain the company and after the IPO they required refinancing and that process continued into 2016 with no success. Three of us — myself, Stuart Barnes, and Keith Henderson — had been working to secure financing at the suggestion of Xtera Communications’ executive in August of 2016. We did a road show event in London and we met H.I.G. Capital, on the second day of that event and they expressed an interest in acquiring the company. When that was not successful, H.I.G. decided on a chapter 11 stalking horse approach because there were a number of potential future issues that a buyout would be subject to and chapter 11 would be a cleaner way to let the process move forward. H.I.G. Capital and the MBO team, were able to acquire the submarine assets of the business out of the Chapter 11 process. With a new CEO and CFO, Doug Umbers and Jayesh Pankhania, the new company was formed in February of this year.

TR: How has the business model of today’s Xtera changed?

RR: The submarine sector had really driven the business for a long period of time. The old company was focused on both terrestrial and subsea markets. Roughly for every dollar in contribution received from the submarine business, more than 70% of that was invested in new development for terrestrial and only a small percentage to sustain the submarine business. We are now truly focused on the submarine market: upgrades, new builds, and recovery and redeployment of systems. We have introduced a number of innovations into the submarine market over the last few years commencing in 2011 with the 100G product on undersea submarine systems. We were the first to introduce the new repeater with considerably more bandwidth than our competition in 2013. In 2016, we introduced a new branching unit for the undersea market. In summary that’s where our focus is, and where our competence lies.

TR: How are you differentiating yourself from your larger competition in the subsea cable marketplace?

RR: Our business model is differentiated against our competitors, we utilize an extended enterprise model, which enables Xtera to be cost competitive as we have zero overhead for cable and marine installation. We’re an agile company and can respond to customers’ needs, and focus on areas where we see opportunities. Currently, we’re focused on regional markets as opposed to the transatlantic or transpacific markets. We see a major opportunity currently for a large number of regional systems in various markets. Our capability is in engineering, technology, innovation and providing new approaches to the market. We leverage partners to provide the other elements such as cable, power feed and installation services, required to build systems. This approach enables Xtera to focus on the core technology and outsource ‘best in class’ of the other elements to supply a highly reliable and integrated customer solution.

TR: Where do the fiber-optic cables actually get manufactured?

RR: Currently, we’re working with Nexans out of Norway, and are in discussions with two other cable suppliers. One of the challenges with cable is, geographically the manufactured cable has to be transported to the installation site. Nexans are ideally suited to do that for the Atlantic, the Caribbean, and the Mediterranean. When considering the Pacific or Southeast Asia, ideally you have a supplier in that part of the world because otherwise you have a significant transportation cost to deliver the cable from the factory to the installation location.

TR: How do you plan to take on the established players in this space?

RR: I think you have to strategically look at where you can attack and be successful, and then you build momentum from there. You can’t do a frontal assault when you have three competitors that control the whole market. It’s difficult to break in, but there are significant opportunities. That’s why we picked the regional starting point instead of trying to go after the very large projects on day one. We will scale to transatlantic and transpacific in time. Our immediate goal is to deploy as many systems in the water and demonstrating our technology so we have a record of delivery and reliability that we can build success upon. We’ve been looking at regional networks in and around the Atlantic, the Middle East and the Caribbean. There’s also a lot of interest in the Pacific to connect islands that are only served by satellite. There’s a lot of development banks and other sources of financing that are assisting some of these island countries in getting themselves connected by a cable.

TR: Has the rise in influence by big content players affected your approach to the market?

RR: The content providers are definitely influencing the direction of technology because they’re looking for massive amounts of bandwidth. When we developed the repeater that we introduced in 2013, it offered greater bandwidth than others and we had anticipated the market demand for ‘big pipes’ driven by the OTT’s. Product development will continue to focus on ‘Capacity and Reach’ which is ultimately Xtera’s value proposition. The OTT’s are now engaged in new systems. Although they typically don’t want to be the landing party or the network operator, there is significant participation in the selection of the supplier. We do engage with them, our new technology is exactly what they require and it has helped the markets evolve. I don’t see that changing anytime soon.

TR: How does demand for new cable systems look to you right now?

RR: There is a lot. For both the transatlantic and the US to the Latin America the market is hemorrhaging with the demand for new cable systems. You have the MAREA system with Facebook and Microsoft, and then there’s at least two other new transatlantic systems being discussed as well. Between Brazil and the US. You have the Google system, MONET, the Telefonica system being built into Virginia Beach, the Seaborn system that’s being built to New York, and one that Telmex implemented a couple years ago. So you’ve got four new cable systems in that market in between 2015 and 2018. Then there’s systems that are being planned the Caribbean as well because of the need for expanded bandwidth on older systems there. And in the Mediterranean there’s a lot of activity connecting some of the islands that have older cables and want to have more bandwidth. Content, in the form of video, is king.

TR: What’s the biggest challenge you face currently?

RR: I think it’s communicating with the market, which is one of the things that we’re doing differently. In the old Xtera, we had our own internal marketing. People would often say, “Great technology, but nobody knows exactly what they’re doing.” In the new Xtera we’ve hired iMPR to help us with the communications so that we are communicating regularly with the marketplace. In addition, when it comes to submarine projects, the buyers tend to be conservative and we have to get them beyond that. I think winning new projects will demonstrate that we’re a company that’s here for the long term, financially strong with market leading technology.

TR: Upgrading and repurposing existing systems has also been important to you, what’s involved in doing that kind of work?

RR: Upgrading just means that you need to have enough spectrum available. You have a fiber pair and remove the old technology and add Xtera’s Optima platform, or you have a shared fiber pair with enough spectrum to start the upgrade. From here channels are added and the old technology is removed until the system is fully upgraded. That’s an industry standard procedure now. Repurposing systems, i.e. recovering and relighting them, is a little more complicated. Systems are in the water today, and were engineered for high reliability resulting in an incredibly high available lifetime. Yes, they typically have an economic life of 25 to 30 years, but in many cases their actual ability to perform is significantly longer as the system is laying on the bottom of the ocean in a very benign environment. The areas where you have the greatest risk to a cable system are in the shallow water, on the coastline, where the water is below a thousand meters. But if you have a system where the majority of the cable is in deep water, you have to be able to recover them in order to repair them. So, if you want to repurpose the system, you have to recover the system onboard the ship. It has to be fully inspected through the process of recovery on board ship. The cable is transferred to a factory location and is re-engineered, this can be with new terminals or even a change of repeater spacing.

TR: What drives the economics of whether to repurpose an old cable or build a new one?

RR: Typically you want to recover and repurpose the cable, generally the re-deployment is in the same region because the transport costs drive the economics. Also, the typical bandwidth requirements for these systems are not as extensive. It’s particularly attractive for small island countries in the Pacific where their bandwidth requirements are typically not extensive, but they certainly do need to have cable in addition to any satellite capacity they may have.

TR: Thank you for talking with Telecom Ramblings!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Industry Spotlight · Telecom Equipment · Undersea cables

When a consortium of 19 leading carriers in the submarine market has chosen Xtera as a supplier for one of the most reputable cable system in the last decade, no one there had imagined that Xtera would fail to deliver !

No one of these 19 carriers will even touch Xtera with a stick in the future.

Chapter 11 was maybe a cleaner way to take the company forward, or in other words – to avoid paying employees or contractors (and some customers) for what was contractually committed.

Practically, it is the same company and DNA where few executives have been replaced. No more.