The shares of TW Telecom (NASDAQ:TWTC, news, filings) jumped unexpectedly yesterday just after lunch. It seems all it took was comments by Corvex’s Keith Meister at the Ira Sohn conference to the effect that tw telecom is a likely M&A target. This is not the first time this rumor has hit the mill, and it won’t be the last. But if he’s right, who would be doing the buying?

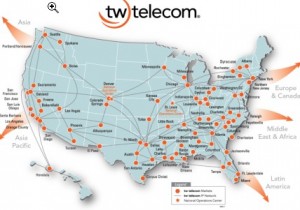

Not Level 3 I think. Oh, the asset fit is a fine one and does get better all the time given Level 3’s shift toward enterprise revenues. Combined the two companies would have in the neighborhood of 30,000 buildings on-net, and there would certainly be synergies that could be derived along the way. The metro and intercity footprints themselves are fairly complementary, as tw tends to be stronger where Level 3 is weaker, and vice versa. But the dynamic is that tw telecom would require a premium that there’s little chance Level 3 would agree to right now. Level 3 just emerged from an era where it had to buy in order to achieve the scale to shoulder its own debt. Their problem in the US is finding the formula for real organic growth, and they know it. And if they do want to spend a few billion dollars, it will surely be in Europe where they can get more bang for their buck.

Until last year this time, I’d have laughed at the possibility of Zayo coming up with the more than $5B it would take to buy tw telecom. But there’s no reason the path they took to buy AboveNet couldn’t be replicated on a stage three times the size. The private equity money is there if the price is right. The asset fit is a very good one, although I don’t know if the enterprise/wholesale differences would mesh all that well. But I’m certain Dan Caruso and his team would love to get their hands on tw’s fiber and on-net buildings if the opportunity arose.

Until last year this time, I’d have laughed at the possibility of Zayo coming up with the more than $5B it would take to buy tw telecom. But there’s no reason the path they took to buy AboveNet couldn’t be replicated on a stage three times the size. The private equity money is there if the price is right. The asset fit is a very good one, although I don’t know if the enterprise/wholesale differences would mesh all that well. But I’m certain Dan Caruso and his team would love to get their hands on tw’s fiber and on-net buildings if the opportunity arose.

But Comcast, which Meister also mentioned, seems like a long shot to me. Sure they could do it, but a piece of tw telecom’s footprint runs through TW Cable’s conduits and there are non-compete conditions there as I recall that could make things tricky. But more to the point, Comcast has plenty of runway to work with on the smaller end of the enterprise market, and tw’s footprint would take them far outside their home turf much of the time. There would be fewer synergies available in a deal with a cable MSO as well, so they’d really have to want in on the mid to larger enterprise market.

AT&T or Verizon are unlikely buyers of course. Neither has shown any interest in buying fiber assets, as both are focused so tightly on wireless these days. With the FCC in still fairly unfriendly hands, it also seems likely a move on tw telecom’s enterprise-heavy fiber footprint would face substantial scrutiny. Windstream probably doesn’t have the firepower at this time, but it’s not entirely out of the question of course. Of the major ILEC networks, CenturyLink is by far the most likely. They could certainly pull it off, they have the most need for the assets and could find a whole lot of synergies, and they were the rumor of choice last autumn. But they don’t seem too interested right now in consolidation or in paying up for it. That could change of course, but I’m still skeptical.

Then there is the rest of the private equity-backed field, the most obvious of which is probably Lightower. Like for Zayo, the possibility of them making a move on tw telecom not as unthinkable as it once was and the asset fit is pretty good. But it’s probably less likely than it is for Zayo just given the limited geographical overlap.

I don’t see any large foreign-based network operators as terribly likely, since right now they could probably get Level 3 at a cheaper multiple and with a customer list they’re more likely to relate to.

Personally, though, I still think tw telecom ought to be the one doing the buying. The network platform they’ve put together would be great for consolidation, and they could fill the few remaining holes in their footprint and product set. My favorite target for them has historically been XO, but such a deal has obviously never materialized. Ah yes, Meister was on XO’s board of directors – small world…

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

This article is a screaming call to CarlK! Take it away with your great CAP CALL. We all wait eagerly for your message.

TW has done a large omount of building network but they still have an abundance of there fiber assest from agreements with cable companies. Those agreements I am curious as to duration, amount of fiber available etc. I believe they are somewhat constrained and Ring size for ethernet and sonet is 10 + buildings. Obviously not stopping them from success but of you are kicking the tires you woudl have to be concerned.

This is similar to Leve 3 with the Telcove asset they acquired large presence in multiple markets but leased IRU/settelment agreement with a shelf life, capacity limit, and large muti site rings that mke adding new builings and cutomers challenging nd costly as electronics uplift and groom old to new to gain further capcity is needed.

Not show stoppers but a consideration when evaluating TW.

TW comments in a PR a few minutes ago….

May 09, 2013

9:07am

LITTLETON, Colo., May 9, 2013 /PRNewswire/ — tw telecom (NASDAQ: TWTC), a leading national provider of managed services, including Business Ethernet, converged and IP VPN solutions for enterprises throughout the U.S. and to their global locations, today issued the following comments on the filing of Schedule 13D beneficial ownership report by Corvex Management LP (‘Corvex’) reporting their 5.77% ownership in the Company.

During its 14 years as a public company, the Company has demonstrated a long history of open dialog with investors and looks forward to continuing to receive ongoing investor input, including from Corvex. tw telecom’s Board is committed to creating shareholder value and believes that the Company is well positioned to continue to do so with the Company’s investments in next generation services and infrastructure, among other initiatives, including its share repurchase programs and other balance sheet activities. The Company has a long track record of producing strong long-term, consistent results, including 34 consecutive quarters of sequential revenue growth, ongoing product innovation and exceptional execution.

Was that just a long-winded way to say ‘Welcome aboard, big mouth…’ ? 🙂

Rob,

I had heard the buyer last fall was TWC as well(as CTL). After peaking through the stink that is cablevision this morning – maybe more scale in a better biz would be the right fit at TWC.

SI

I do like TWC better than Comcast as a buyer I suppose. Maybe then they could merge with TWX and be one big happy family again… 🙂

That’s what I’d bet on, Rob. I think the majority of fiber leases twtelecom relies on are with Time Warner Cable. Based on a twtelecom report issued a few years ago, these leases are scheduled to expire in something like 16 or 17 years. The only potential purchaser for which these leases should not present a concern is TW Cable.

Absolutely, it means, “for sale” sign doesn’t need to be hung, it has always been there if you want to hit her multiple. I have little idea what that multiple is.

Meister launching the ABVT sale process as well as the Icahn background and the scale means that this activist means a bit more in this situation.

You are absolutely correct that tw should be the one consolidating… they just do not have the right management team to execute that sort of plan. Don’t get me wrong, they are good operators, but they lack the strategic vision to pull off being a consolidator within the industry. They have admitted they are extremely cautious and have only pulled off 2 significant acquisitions during their tenure. As much as I think Larissa is an admirable person, she is not the right leader to execute that strategy.

Please don’t let Zayo destroy another good company buy purchasing it!

Those idiots can’t seem to get it right and could use some Executives with a strong Telco track record running the company.

They won’t listen, they have burned thru many and I am talking many talented good people from, XO, TWC, L3, Southwest Bell, should I go on?

They look more like an investment bank trying to roll up assets then sell them off for a profit than actual telecom operators.

That said, we are benefiting from this!

I will respectful disagree with Anonymous. Zayo at this point is attracting some of the best talent in the industy. If you are a planning and constrcution person who has more interesting and ongoing projects ? If you are sales who has more opportunity and ability and grow with you in any area you sell, really anblank sheet waiting for you to take advantage, bring a concept develop and build it. Then financial, project managemnet, HR, offer managment , real estate etc etc Zayo has a need due to there massive builds and I think that attracts the top talent. Tough place yes but a good hom, although many very solid people have left due to demands of work

I find it interesting that Corvex’s Chief Investment Officer is Charles Meister, former Chief Executive Officer at Icahn Enterprises from 2006 to 2010. Seems to me that Mr. Meister believes there’s more value to uncover at TW Telecom. Are we about to see some “activism” unfold whereby TW Telecom’s execs will be under pressure to provide more shareholder return on investments?