These days plenty talk about building fiber infrastructure, but few have taken on the task of rebuilding the infrastructure of one of the biggest markets in the world from the ground up. But that’s what DF&I has been doing when it comes to northern Virginia, and that’s what they hope to replicate elsewhere even as they continue to add new routes. With us today to explore their vision of the dark fiber and conduit business and where DF&I might go from here are the co-founders and veteran fiber builders John Schmitt and Judd Carothers.

These days plenty talk about building fiber infrastructure, but few have taken on the task of rebuilding the infrastructure of one of the biggest markets in the world from the ground up. But that’s what DF&I has been doing when it comes to northern Virginia, and that’s what they hope to replicate elsewhere even as they continue to add new routes. With us today to explore their vision of the dark fiber and conduit business and where DF&I might go from here are the co-founders and veteran fiber builders John Schmitt and Judd Carothers.

TR: Why did you start Dark Fiber & Infrastructure? What opportunity did you see in building at such scale at the infrastructure layer?

JS: We saw a need in the market that people weren’t fulfilling. When Judd and I started working together 25 years ago, everybody was telling us, “Why would you sell dark fiber? Don’t you know how much more money you can make on capacity?” This time we started out with the same concept, but we took the scale up multiple notches. We recognized that same demand with high-count dark fiber and dedicated conduits. Just like before, we have heard some of the same echoes suggesting we are crazy to do transactions on that scale.

JC: They saw it as selling one’s assets — everything was focused on depletion as opposed to optimization.

TR: Why do you think their viewpoint is so different from yours?

JS: There is nothing about the actual deals that people don’t like; it’s that most simply don’t have the inventory and the scale of assets to compete in that market. The people who thought we were crazy for selling dark fiber had a couple of dozen strands of fiber on their network if that much. We put large conduit banks in the ground, and that puts us in a position where we can solve a need. There are more and more customers with a desire for that level of scale.

JC: Even if they’re not at that level now, our product set gives them the opportunity to not only satisfy their near-term connectivity requirements and fiber counts but also to future-proof whatever those counts might evolve upwards into with very little incremental capital.

TR: Northern Virginia is not exactly an underserved market when it comes to infrastructure. Why start there and focus solely on fiber and conduit?

JS: First, it was familiar to us. We had built there multiple times in our past lives. Second, we had people saying it couldn’t be done, that the rights-of-way were completely full, and that there was no way to get permission to put assets in such a congested geography. And the reality is most people can’t. But we knew we could get it done. We have seen the whole ecosystem grow up from inception. And third, we like the simplicity of it. We’ve run managed networks and we’ve sold a huge suite of products throughout our careers. But our absolute favorite type of business is dealing with users of infrastructure, both small and large. In many cases, you are dealing with very sophisticated entities, which leads to inspiring conversations, and we really enjoy that.

JC: Picking the place to start was every bit about familiarity as it was about understanding that the most requested product simply wasn’t available for the consumers to purchase or buy. In and around Ashburn, everybody wanted (and still wants) conduit. Before we went in and overbuilt the system, you could not buy a conduit. Understanding how to do what everybody was asking for but wasn’t currently available in the market helped make that a very logical decision.

TR: What does your infrastructure look like today? What have you built so far?

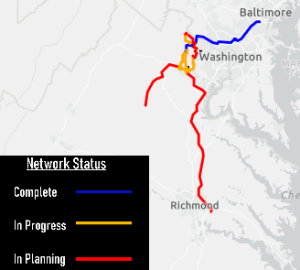

JS: We have north of 150 miles of network in the ground right now, spread out between Ashburn, Data Center Alley, and Manassas. We have put a minimum of 12 conduits in Virginia, and in Data Center Alley, it is 28. We also built under the Potomac River to a point just south of Baltimore to help customers get from the I-95 corridor and into Data Center Alley without going through the District of Columbia, and that is six ducts. From a dark fiber standpoint, we stick to a fiber count of 864.

JC: The conduits that we install have the capability for us to install 3456-count or even up to 6912-count. So we do not worry about being short on inventory to supply fiber to the marketplace. We also maintain a maintenance conduit, which gives us the flexibility to continue to scale the inventory of the business with very little incremental cost. We don’t have to overbuild to increase fiber capacity. We simply pull another cable in.

TR: What expansion projects are you currently working on in northern Virginia?

JS: We have completed our build to Gainesville and Haymarket already, and we are building through Gainesville and Manassas and back up right now. We have also actually built out to Leesburg as well. Both of those projects are well ahead of schedule. We have projects in the planning stage to build down to Culpeper and to the Richmond area. As we look at Culpeper and further south, we are following the tea leaves very closely with the expansion of clusters of data center properties. We’ve really liked the idea of connecting to Richmond for a long time. It’s not necessarily for connectivity into the eastern seaboard for the transatlantic cables, although that’s a component of it. We see Richmond more as an aggregation point for the entire East Coast route. The ultimate demand there is really yet to be determined, but it’s got a lot of those early indicators that we look for.

JS: We have completed our build to Gainesville and Haymarket already, and we are building through Gainesville and Manassas and back up right now. We have also actually built out to Leesburg as well. Both of those projects are well ahead of schedule. We have projects in the planning stage to build down to Culpeper and to the Richmond area. As we look at Culpeper and further south, we are following the tea leaves very closely with the expansion of clusters of data center properties. We’ve really liked the idea of connecting to Richmond for a long time. It’s not necessarily for connectivity into the eastern seaboard for the transatlantic cables, although that’s a component of it. We see Richmond more as an aggregation point for the entire East Coast route. The ultimate demand there is really yet to be determined, but it’s got a lot of those early indicators that we look for.

TR: Do you see additional potential around the data centers up in Maryland?

JS: When we built our route into Maryland, we solved what we set out to do. However, we have long believed that Maryland could be a very popular data center expansion area, and we would love to see it really pick up steam from a hyperscale development standpoint. That would be a force multiplier for us, and you would likely see us pick up and start building more arteries through Maryland. But right now, we’re in a wait-and-see mode.

JC: And that’s one of the keys to the thesis: trying to understand and be ready when the customers are. Once the customers figure out what they want to do, you’re already behind. One of the core principles that we try to adhere to is making sure that when they’re ready to go, we’re ready to go.

TR: Are any other markets attractive to you in terms of replicating your success in northern Virginia?

JS: That’s all part of the logic behind why we started the way that we did, and you can think of what we have done as a proof of concept being successfully executed. We are actively looking at other places where we can do this, but we won’t talk a lot about where we’re seeing such opportunities until we’re really committed to it. But we are already a certificated utility today, not just in the Commonwealth of Virginia and Maryland, but also in Texas, Florida, Tennessee, Ohio, Illinois, and Georgia, and that list is expanding.

TR: How would you fund an expansion into a new region?

JS: In 2020, we became an IPI-affiliated company, which means we are private equity-backed. Access to capital is a non-issue for DF&I right now. We’re not out there trying to raise money, hoping to hook a project so we can go and bring capital to the equation. Even though we’re only a six-year-old company, that stability and the fact that the business is staged for growth mean a lot. We are an organic growth company, and we are getting ready to scale. Every deal, every partnership, everything we do must be incrementally positive for us, and you only get that with greenfield builds. From our vantage point, when you are building from scratch, that is the very best way to break into a market and get incredible returns on an investment.

TR: To what extent does your own local knowledge of such areas influence your decision about whether to enter a new market?

JC: Going back through our ACSI days, we were fortunate to be a part of the teams that built 30 metro markets in 30 months. We have a long history of working in the southeast, in a triangle from Baltimore to El Paso to Miami, and we’ve been deliberate about retaining those critical local relationships. We’re looking for markets which have the widest spectrum of parallel opportunities. It shouldn’t be just a hyperscale-only play or a carrier-only play. The greatest diversification of potential customers and opportunities is as important to where we go as is our familiarity from building there previously.

TR: Every geography has its challenges. What are they in northern Virginia?

JC: Congestion, familiarity, and rock. You are drilling through 40,000 and 50,000 PSI quartz-infused granite, which is expensive. You have to understand the process, have the relationships, be willing to work with the municipalities and the permitting agencies, figure out what we need to do to make their lives easier, and move forward. Just because there’s a perception that these things are impossible to do, doesn’t mean that’s true. And once you get something in, it’s valuable to be able to say no one else is likely to ever come in and do it again. Building is hard, and it takes a certain skill set. That’s why there are so few builders. Luckily, we’ve got that in spades amongst our groups. We look for those 100% Greenfield opportunities because that’s where we can really accelerate and make a big difference for our customers.

TR: I have heard that data center development in Loudon County has been constrained by the availability of power. How has that manifested from your perspective?

JS: It’s not our area of expertise, but our understanding is that the issue is not about the generation of power but rather the transmission and distribution capabilities. What we have seen is that this has accelerated the expansion in markets further out. Compare the building that was going on in Manassas four years ago versus today. Look at the announcements even further down south in Virginia.

TR: How have you seen the demands of hyperscale customers evolving in recent years?

JC: It’s all about power, space, and connectivity from our perspective. We’re seeing an increase in demand. It’s not that we’re trying to bet on whether it’s there or not. It’s about making sure that the product is available for monetization and consumption.

JS: And that demand is the best thing that can happen to a business: to find out that there’s more demand than you anticipated rather than less. We obviously saw the hyperscale demand, and we saw the carrier demand. But we didn’t see what was coming with AI. We didn’t see the requirements that would ultimately result because of COVID. It doesn’t happen very often, but these things are falling our way. But we’re not just a couple of guys that got lucky. We were at least smart enough to put adequate infrastructure in the ground so that when it happened, we’d be ready. That is the critical differentiator: from the very beginning, we felt that if you’re going to go through the effort of building, build it so you only have to do it once.

TR: Why do you think there are few true builders of networks out there right now? Why is it harder to be a builder than a buyer of infrastructure?

JS: Basically, builder DNA is just not that common. There are a few other builders out there getting some traction. We also see some operators that recognize the benefits and then go and build something for themselves, but they’re still primarily operators, and as such, they only build enough to support the demand they can see clearly. There are many more that are talking about it but aren’t actually building anything. For the most part, my perception is that they are trying to build based on the hope they can go out and land a customer. They are not coming to the business from a vantage of “These are the pieces that I want to capitalize on.” They’re waiting for somebody to tell them what to do and where to go. And I think that’s a big differentiator. We have those conversations too, but it’s very rare for us to just respond with a price. It is much more likely we come back and ask, “Have you thought about it this other way? Here’s what we’re seeing from a demand perspective.” With almost 100% certainty that the design ends up being altered based on the collaborative feedback that we’re able to provide.

We want network operators to see us as a development partner, as an owner-operator, and as a builder of infrastructure – built for network operators by network operators.

TR: Thank you for talking with Telecom Ramblings!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Industry Spotlight

Discuss this Post