Zayo certainly has a bottomless appetite for metro fiber. With the Arialink deal on the books for just one month and the AboveNet deal set to close in the next month or two, the company struck yet again with a big Mid-Atlantic purchase. Zayo said today that it is buying privately held FiberGate, boosting its presence in Washington DC and the surrounding region in a big way.

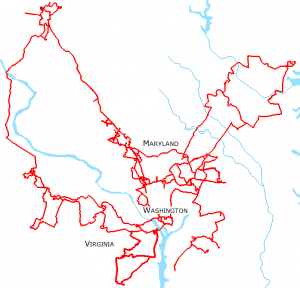

FiberGate operates 650 route miles and 130,000 fiber miles across the region (i.e. a fiber count of 200), hooking up 315 buildings along the way including both the major data centers in Northern Virginia and minor federal sites like the White House, Pentagon, and Andrews Air Force Base according to the company’s website. That footprint will fill out Zayo’s current relatively basic DC metro area assets very nicely, and even more nicely when added to the Abovenet assets after that deal closes.

FiberGate operates 650 route miles and 130,000 fiber miles across the region (i.e. a fiber count of 200), hooking up 315 buildings along the way including both the major data centers in Northern Virginia and minor federal sites like the White House, Pentagon, and Andrews Air Force Base according to the company’s website. That footprint will fill out Zayo’s current relatively basic DC metro area assets very nicely, and even more nicely when added to the Abovenet assets after that deal closes.

FiberGate is strictly dark fiber as currently operated, but you can be sure that Zayo has more extensive plans in mind for the assets. The purchase is expected to close by the end of the third quarter.

That’s four deals now in the first half of 2012 alone, including the MarquisNet purchase at the beginning of the year. Are they done for now? They certainly will have their hands full for the rest of the year with the integration work they’ve lined up so far. But Caruso is a man on a mission, and he seems to like these prices – so another deal or two aren’t out of the question. Integrating a pure dark fiber asset like this is much easier than a more complicated lit business.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

Zayo,

Level 3 would love to buy out your snowball when you get done rolling it up.

By the time they get around to it, it just might be the other way around…

without a doubt

Mr Scott,

Worked for you & your team a few years back. What do you think that snowball is worth?

cheers

Is Zayo an operator or builder of fiber networks. Level 3 had no problem builidng fiber networks either in there early day, there challenge came after the fun of building ended. Safe to say Level 3 has not figured out yet. Zayo in the form of buying companies is in building mode. What will be very interesting when they start operatiing and how successful they will be. Is there a difference of zayo today building thru acquisition and Level 3 building.

The fact that the availability of FiberGate fiber is now off the market, we all know carriers prefer to sell lit and will not sell dark unless there are mitigating circumstances, can not be good for anyone looking for dark fiber….this trend is not good.

But Zayo does sell dark fiber, and reports it as a separate unit – so this fear is probably unfounded.

But it goes without saying that with the FiberGate and AboveNet footprints in Zayo’s hands, the DC fiber business will become radically different in a few short months.

sure they do…if it’s a last stand to losing a deal…point is, most of that and other assets they have acquired are not and will not be sold as dark strands….seen it, end of story.

Of course not every route has fiber available but where fiber is available Zayo will definitely lease/IRU it. If you use their online map tool toggle off the longhaul fiber and it will give you a better picture of DF.

Worry not, selling dark fiber is an important and growing part of Zayo’s business strategy.

Yet again Dan is demonstrating his strong understanding of creating value for his shareholders by acquiring assets that will when combined position Zayo as well as its valuation successfully towards the future. Congratulations …. Well done.

That’s a little premature Grant. He’s yet to prove value to anyone other than himself, and a few others close to him. He didn’t leave L3 because he was so highly desired, but because his head couldn’t fit through the same door as Kevin O’Hara. From what I hear it’s a lot of smoke and mirrors at Zayo so only time will tell.

I was merely pointing out that the acquisition of fiber assets will inherently drive valuation up over time as supply will decrease as demand grows. Moreover it’s clear the individual assets are more valuable when leveraged (put into service, measured in valuation, sold, etc)in totality than individually. Regardless of the reasons for his departure I suspect he’s quite happy doing what clearly will result in a sale transaction in the future.

one could argue that the value creation has been very significant to the founders and original investors. As a private business is that not Zayo/Dan responsibility ? Additionally many many jobs have been created by Zayo ( and yes I know many RIF occur during rollup). Now as they move toward public investment and into a different stage of business developement the value creation criteria changes. Likelt starts with the new money to support the Abovenet purchase and can business grow fron that entry point

I would have to assume others bid on this? Perhaps Sidera. If so, I would think this hurts Sidera since they recently announced they were seeking fiber assets in this market.

I would assume so as well, but I haven’t heard any details of the auction. Sidera certainly seems likely to have been in there somewhere though.

Industry Observer — There is some truth to what you say. When I parted ways from Level 3, both Level 3 and I thought my departure was for the best. I made my fair share of mistakes in the earlier portions of my career. Hopefully I learned from them.

After Level 3, I led a take private of ICG. You might want to get up to speed about what transpired while I was there as you opine on me/Zayo. Short summary: $8.7M of equity investment turned into ~$225M exit within 2 years. Hard to argue that the outcome was anything other than excellent for investors.

Additionally, your comment on Zayo is not as informed as it could be. We have public debt and we provide substantial transparency on our financial performance. From this information, you could learn how the company has been doing, including making an estimate on how Zayo’s equity investors are doing. Perhaps this data will help you see through what you refer to as “smoke and mirrors”.

If you would like me to take you through our public financial material, please email me.

Dan – thanks again for the follow up as its always good to here from leaders in businesses such as Zayo. How does one contact you should they have a question?

Grant: dan.caruso@zayo.com

Regardless of how anyone feels about Dan you have to admit there are not too many major telecom CEO’s that take time to respond and answer questions about their company in this or any other forum. Thanks Dan!

Agreed, thanks Dan.

Having been in telecom from WilTel to Zayo–I have never seen such excellence in leadership, such strong and disciplined financial management, or such an ability to create shareholder value as I have in Zayo. Couple that with an ability to roll so many companies up and integrate them almost seemlessly onto Zayo’s platforms–having visibility into my customer’s circuits day one–it’s unheard of. We also lead with selling dark fiber, creative solutions that actually enable companies to move from lot to dark fiber and compensate sales on value creation (which selling dark fiber is high npv biz)–not just for closing a high MRR deal with no true value once capital and other costs are stripped out. Zayo moves with agility and speed to adapt and change to keep the value creation at the forefront of every decision made. It’s like nothing I have seen in the industry in my 14 years. I say this anonymously only to preserve the integrity of my comment–but Dan Caruso’s leadership might not have meshed with most telecom companies past present or future, as our industry’s history is filled with bankruptcies and companies with little to no focus on the value creation (oh the list we could make of worthless stock or stock that only stays above $2 price points due to reverse splits). I think the continued investor support to acquire more companies is a great demonstration of their appreciation of Dan’s ability to create true value for all and speaks for itself when you think about it.