This is a guest post by Paolo Gorgò. If you might be interested in a guest post, then contact the webmaster.

Last week, the East Coast of the United States was rocked with a 5.8 magnitude earthquake and that was soon followed by Hurricane Irene, in what seems to represent a unique historic pairing. Such a combination of natural disasters, in a very short period of time, has never happened before.

Data centers in the region proved earthquake proof, as they were mostly capable of ensuring uninterrupted service, with all exchanges operating as usual, and NYSE Euronext only experiencing a brief spike in sell orders moments after the quake struck, followed by a quick recovery once the market understood there was no risk of catastrophic damage.

Unlike earthquakes, hurricanes can be forecasted, and facilities in the New York metro area, including those hosting the main US exchanges, could prepare to stand this second wave of “natural disasters vs data centers”.

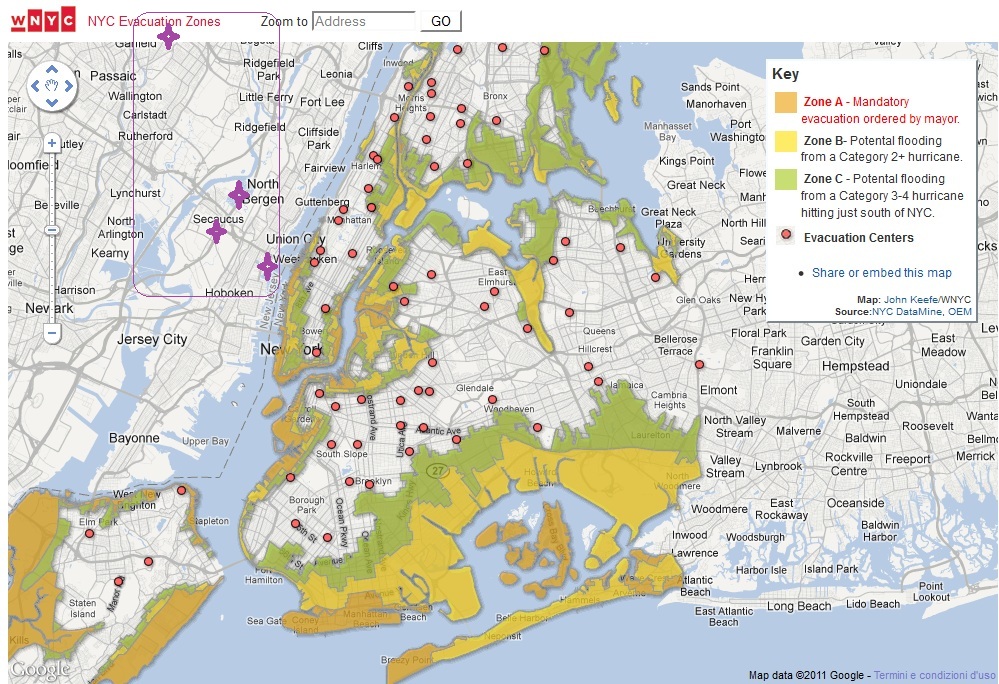

Here is a quick look at the areas, in the New York metro, that were supposed to be hit by hurricane Irene. On the map, we’ve highlighted the area surrounding Manhattan where most “financially sensitive” data centers are located (click to enlarge):

As you may notice, the area was supposed to be relatively safe.

[paoloadbox]

It is, anyway, interesting to see how data center providers were preparing for the event. Equinix (EQIX), that has several facilities in the area, including downtown Manhattan, issued a press release detailing its continuity plans:

What are some of the measures Equinix is taking

The generators have been tested, fuel tanks are full, levels verified, and backup fuel vendors have been placed on standby in the event of extended power interruption.

Special arrangements have been made to make sure staff are available on site as necessary to maintain operability standards.

We have secured hotel rooms near the sites, and have brought in cots, MREs, and other emergency supplies, should the situation become extreme.

Most facilities downtown Manhattan, including Google’s (GOOG) 111 8th Avenue building, were in relatively safer zones, as Data Center Knowledge reported:

The carrier hotels at 60 Hudson Street, 256 Broadway and 32 Avenue of the Americas are all in Zone B, which would only see a storm surge threat from a “moderate” Category 2 hurricane. The New York Stock Exchange and 111 8th Avenue are both in Zone C, which would only flood in the event of a direct hit from a category 3 or 4 storm. While Irene is currently category 2, it is expected to weaken to Category 1 by the time it reaches the New York metropolitan area.

The reference to the NYSE facilities downtown New York allows us to examine the impact hurricane Irene might have had on stock exchange openings on Monday:

“We intend to be open for trading on Monday,” said Eric Ryan, spokesman for NYSE Technologies. ” We have contingency plans in place for such events with the goal of having the market up and running while ensuring the safety of our people.”

The company’s data center in Mahwah, New Jersey was built above flood plains, and engineered to survive high winds.

The New Jersey area opposite to Manhattan, as we noticed on our map, is the region where most exchanges are hosting their operations, either in owned facilities, like NYSE, or in data centers operated by Telecoms like Verizon or specialists like Equinix and Savvis, now a CenturyLink subsidiary.

While the final say was to be left to Irene’s strength, it immediately looked like the NYSE wouldn’t see a repeat of what happened when hurricane Gloria forced the exchange to remain closed for a full day on Sept. 27, 1985.

The WSJ reported in more details how the NYSE was preparing for its opening on Monday:

Lou Pastina, the head of floor operations for the New York Stock Exchange, said on CNBC Friday that the exchange and its member firms had taken hotel rooms for some staff at its iconic Lower Manhattan address and would be on hand to ring the opening bell Monday. He said NYSE Euronext planned to open as usual at 9:30 a.m. but if there is any delay in opening the trading floor at 1 Wall Street, electronic trading can still take place via exchanges such as Arca.

The electronic NYSE Arca platform that could take on trading that would normally go through the Manhattan floor is hosted in Mahwah, New Jersey, and will likely see no impact from the hurricane, as it was built to stand such events. Most of the other exchanges were in a similar situation:

The all-electronic Nasdaq Stock Market, whose billboards light up Times Square, plans to open as usual Monday. The New York Mercantile Exchange (NYMEX), a few blocks from the NYSE, has “contingency plans in place to ensure the proper functioning of our markets,” said parent CME Group Inc (CME).

The physical move of most electronic trading exchanges in locations opposite Manhattan, in an area still very close, latency wise, to downtown, but relatively safer in case of natural events may now be seen as a wise choice, as it is very likely that all markets will be capable of operating without any problem today.

Benedict Willis III, director of floor operations for investment banking boutique Sunrise Securities noticed, resumed very well the risks that NYSE could have experienced on Monday, in its downtown location:

NYSE has a responsibility to open on Monday after the storm passes because millions of investors are relying on it for stock prices.

“But if the waters rise this high,” he said gesturing at the buzzing trading floor, “then it’s a bigger problem than I can handle. My name’s not Noah.”

Luckily, most exchanges understood a while ago that it was really about building the ark in a safer place, and going all-electronic ensuring the maximum flexibility and redundancy in terms of connectivity.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Datacenter · Guest Posts · Information

Is it necessary for an NRI who is already having account to open another NRE/NRO account. Can the account be joint accounts?