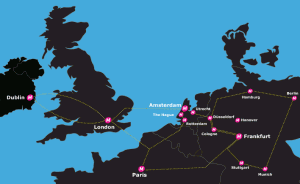

Today we will cross the Atlantic and take a closer look at euNetworks, which operates a metro and intercity footprint stretching across 15 markets in 6 countries in Western Europe. Their metro assets derive from the European buildout of MFN a decade ago, and are connected by intercity fiber that came from a deal with Viatel a few years ago. Given the recent successful resurgence of the former domestic MFN metro assets in the form of abvt, keeping an eye on its European cousin seems like a natural idea.

Today we will cross the Atlantic and take a closer look at euNetworks, which operates a metro and intercity footprint stretching across 15 markets in 6 countries in Western Europe. Their metro assets derive from the European buildout of MFN a decade ago, and are connected by intercity fiber that came from a deal with Viatel a few years ago. Given the recent successful resurgence of the former domestic MFN metro assets in the form of abvt, keeping an eye on its European cousin seems like a natural idea.

euNetworks is at an earlier stage in development, as is the European metro fiber sector in general. It is only recently with several balance sheet moves and the appointment of a new CEO over the past year or two that the company is really starting to focus on and invest in its metro assets. With us today to further examine just what euNetworks is up to nowadays is CEO Brady Rafuse:

TR: While euNetworks has lit metro networks in 13 markets, it thus far earns the vast majority of its revenues from four. Are you focusing your efforts currently on those four where you have achieved scale or on developing the other nine?

BR: I wouldn’t say we’re at scale anywhere just yet. But I think we’re going for the genius of the ‘and’ rather than the tyranny of the ‘or’. We will start to drive revenues from the other 9 operational markets during the course of the year. That takes time to build. For example, if you want to hire good salespeople in Germany it’s a 3-6 month notice period, and then another 3-6 months coming up to speed. If you take Amsterdam and Rotterdam, they have equivalent GDP. Amsterdam is one of the most competitive fiber markets you could possibly be in in Europe. Rotterdam is quite different. Of course massive amounts of what happens in Rotterdam comes from shipping etc., but nevertheless there is a lot of opportunity. When you go to cities like Hamburg, Stuttgart, or Munich, these are significant metropolises. I’m very hopeful that we’ll start to see all of them contribute towards the revenue pool as we exit this year.

TR: Which enterprise verticals are you getting traction in right now?

BR: In the enterprise space for us today, financial services is in front – specifically low latency services. However, we are very encouraged that we are beginning to get real interest from a number of segments that even a year ago would have been too hard to approach. The big difference is that the enterprise market is an upcoming market for us in Europe whereas it is a borderline mature market in the US.

TR: A few years ago, euNetworks acquired backbone capacity from Viatel connecting its markets. What role does intercity fiber play in your business plan?

BR: The backbone is an enabler. The best way to describe it is this. You can fly from London to Dublin for £20, but it’s going to cost you £50 for the taxi out to the airport, and another £50 for the taxi from the other airport. So the enabler is the flight, but it’s the taxis, or the metro area, which is the key bit for us.

TR: What do you see as the major difference between operating a metro fiber network in Europe versus the United States?

BR: I think one key difference is that the European enterprise market lags the US market somewhat. In America the real kick off point for services like ours is Gig-E, whereas I would say that the market here in Europe is probably nearer to Fast Ethernet. So 100Mbps rather than 1G. I think that point has been crossed in the US rather significantly.

The other issue is that I think there is much purer information in the US. Buyers mostly know each of the multiple sellers from whom they are buying and they have good access to information about who sells what where. That transparency of information is not so available in Europe today.

TR: Lately on Telecom Ramblings, we have been revisiting the longstanding debate on the wisdom of selling dark fiber. How does euNetworks approach this issue?

BR: We will sell dark fiber where we have to, which basically means if someone else will sell it on a competitive route that we are on where we have a great deal of capacity. But it’s not a preferred route. Actually, my suspicion is that it’s not really the preferred route of a lot of customers. It may feel really good but it comes with a lot of capex, and it takes you into the world of running a network and all that goes with it. The idea of dedicated fiber, I think, is one where we get a lot of traction, where we say to the customer, “We’ll sell you a pair of fibers which we will light, and sell them to you on a monthly recurring revenue basis in Gigabit increments.” And it doesn’t take long on certain routes to start really burning through capacity once that message is received.

TR: What is the telecom M&A environment like in Europe right now?

BR: In 2001, I was quoted in Capacity Magazine that this would be the year of significant consolidation in the European marketplace. Nearly 10 years on I’m still waiting for that to happen. I think there’s movement. There are two levels of telecom M&A in Europe: who is going to buy which National PTT – i.e. the biggest deals ever, and who is picking off little fiber providers here and there. I think people are trying to work their way through it, but I think we have a significant overhang from an economic perspective to say the very least. It’s very clear how the US market has heated up quarter by quarter over the last 12 months. There haven’t been many significant deals announced over here, but do I think conversations are happening? Yes I do.

TR: Thank you for talking to Telecom Ramblings!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Industry Spotlight · Metro fiber

Another enjoyable interview, Rob. Thanks.

Brady Rafuse’s comments concerning dark fiber are interesting. I think the attractiveness of dark tends to be cyclical, both for financial and operational needs. With improvements in technology (think: GigE and 10GigE switches today that are barely different from those found in the LAN), users are less intimidated than when they were forced to negotiate the seemingly (to them) arcane requirements of administering a SONET or SDH network, say.

Of course, as a network approaches scale, more sophisticated elements may be called into the picture, as wavelength switches and ROADMs begin to add additional complexity to managing your own network, if not also emerging OTN gear as well.

But, so, too, do the financial stakes become higher, thus providing a certain degree of additional counter-impetus, for those capable of managing their own networks, to build rather than buy.

Just my two positrons.

frank@fttx.org

We should remember that when Brady Rafuse talks of dark fiber sales, they are in the metro, whereas much of the earlier discussion was about intercity routes.

Great interview rob. As a friend of brady’s and an investor in eunetworks, I am excited about eun’s prospects. Go get ’em Brady