The news over the weekend seems to be that TW Telecom (NASDAQ:TWTC, news, filings) is for sale and that CenturyLink (NYSE:CTL, news, filings) is close to making the deal happen. The rumor is in the Denver Post, but seems to have originated with the DealReporter website. Does it make sense? Yes, it might – but it also might be the simple re-emergence of the same talk we’ve heard on and off about CenturyLink’s plans.

The combination of CenturyLink and tw telecom would certainly have some strategic sense behind it, just as a few years ago it was relatively easy to put together the Qwest longhaul network with tw’s metro depth on paper. Qwest’s longhaul network was always weak in terms of on/off ramps to its backbone outside of its ILEC footprint and hence its enterprise penetration there was anemic. Both were tw’s strengths, while tw lacked the complementary intercity assets and wholesale capabilities. But at the time Qwest just didn’t have the firepower to pay the necessary multiple, and tw wasn’t aggressive enough to try to buy the longhaul piece from them.

The combination of CenturyLink and tw telecom would certainly have some strategic sense behind it, just as a few years ago it was relatively easy to put together the Qwest longhaul network with tw’s metro depth on paper. Qwest’s longhaul network was always weak in terms of on/off ramps to its backbone outside of its ILEC footprint and hence its enterprise penetration there was anemic. Both were tw’s strengths, while tw lacked the complementary intercity assets and wholesale capabilities. But at the time Qwest just didn’t have the firepower to pay the necessary multiple, and tw wasn’t aggressive enough to try to buy the longhaul piece from them.

CenturyLink, on the other hand, is a whole different ballgame. If they want to make it happen they can, and they’re not afraid of paying a premium if the strategic direction is right. They surprised me by buying Savvis because I felt that Savvis didn’t need to sell and therefore could hold out for a big price. But CenturyLink stepped up to the plate to pay $40/share to bring the deal home.

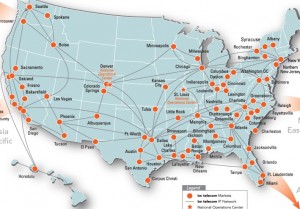

Now with Savvis’s cloud/colo infrastructure, Qwest’s longhaul, and a clear appetite to make big inroads in the enterprise market, if one asks what CenturyLink would buy next what would it be? Many have said Level 3 would be a target, but it’s just not optimal IMHO as the international assets don’t fit, the enterprise growth capability is not proven, and the price tag would be very high. But tw telecom, on the other hand, is looking like precisely the right puzzle piece: 20K+ metro route miles with 16,000 on-net buildings, and a finely tuned enterprise-focused business model with room for revenue synergies by selling cloud services to its connectivity/Ethernet/VPN/Voice customer base. And it’s fully US domestic, with almost no legacy baggage.

I’ve always thought tw telecom would do well as a buyer, but they have chosen a very conservative path since the Xspedius purchase back in 2006. They’ve spent capex aggressively of course, but it has nearly all been for depth – adding nearby buildings to existing loops. They haven’t added many metro route miles to their total in that time, nor have they entered any new markets. Just more on-net buildings, and lately at an amazing clip of 2,000 per year.

Yet as a solid, profitable fiber operator that throws off more cash than it is able to spend with capex at 25% of revenues, tw telecom is in a very strong bargaining position as a seller. They recently announced a move on the debt markets, planning to sell $480M in preparation of paying off some convertible debt they can redeem next Spring. That’s not the kind of move one makes if a deal is known to be imminent. The only real driver for them to sell would be the premium paid above today’s stock price.

A public company is always for sale in that sense, so I’m not sure what to make of the DealReporter rumor that negotiations are several weeks old and closing in on a deal. To be honest, I would expect these two (and others) have had such conversations every year for the past five. Is CenturyLink ready for another deal? I had thought next Spring more likely, but perhaps opportunity has knocked.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: ILECs, PTTs · Mergers and Acquisitions · Metro fiber

I would think all “leaks” are purposeful and that TW Telecom has officially shopping itself. The leak is to drive price higher and Centurylink is not closing the deal imminently rather their name is being used ( although likley may be in the game to buy). With Cable companies, LEvel 3 looking for enterprise sales and likley others you can easily speculate that TW has many options and suitors. No one would telegraph the move unless they are purposely doing so.

This signifies a bidding war more than a closed deal for centrurylink. But the big news is TW is on the block.

Could be. But IMHO Level 3 is not yet ready to take a swing at TW. Maybe Comcast/Cox/TW are more likely. And you never know, Zayo’s backers might have even more in those deep pockets than we think. But for right now, if the race is underway I think CenturyLink is probably the one with the pole position.

How many years remain on TW’s IRU arrangement with Time Warner Cable? The fact that, within that period, TW will have to either replace the majority of its network or pay Time Warner’s asking price in order to extend the IRU or buy the fibers can be expected to discourage potential buyers. It seems to me that Time Warner will be in the catbird’s seat if it has an interest in acquiring TW.

Good question and good point. TWC will be the one with the best deal, by default. If the IRUs were mostly 10 year, I would assume it comes due in the next couple years at most.

From twt’s 2011 Annual Report:

The Company licenses the right to use fiber optic capacity from Time Warner Cable, Inc. in 16 markets,

Comcast Corporation (as successor to Time Warner Cable) in three markets and an affiliate of Bright House

Networks, LLC in four markets. The Company pays and records as a component of property, plant and

equipment its allocable share of the cost of fiber and construction incurred by Time Warner Cable, Inc., Comcast

Corporation and the Bright House Networks, LLC affiliate on routes where the parties are in joint construction.

Fiber Lease and License Agreements. We provide a substantial portion of our services entirely on fiber

network facilities that we constructed, purchased from other providers or obtained through acquisitions. We also

license fiber network facilities through indefeasible rights of use agreements or other similar long term licensing

or leasing arrangements (collectively “IRUs”) from other CLECs and cable companies. We typically paid for

these IRUs upfront, and they generally have terms lasting over 20 years. Similarly, our Capacity License

Agreements with Time Warner Cable, Comcast Corporation and Bright House Networks, LLC (collectively, the

“Cable Operations”), provide us with an exclusive right to use all of the capacity of specified fiber-optic cable

owned by the Cable Operations in 23 markets for a term that expires in 2028. The Capacity License Agreements

do not restrict us from constructing or licensing fiber-optic capacity from other parties in the markets where we

license fiber network facilities from the Cable Operations.

I think all those licenses from the “Cable Operations” originated with Time Warner Cable. Bright House apparently received its share of these licenses from Time Warner when the two companies divided up TWEAN, and Comcast obtained its share, I’d guess, when it and Time Warner swapped some systems and cash during their acquisition of the Adelphia properties. I am not sure whether dealing with three companies will be better or worse for TW.

If true, it is very disheartening, as an employee. Look for morale to collapse overnight, and the good ones to start looking to jump ship ASAP….

Maybe, but it’s not true yet. Let’s not be hasty…

Okay I get it. But the market believes it is a legitimate rumor. Let me appeal directly tho I am pretty sure many of them read this blog.

Larissa Ive taken very seriously over the years your statements that you truly value the employees. Its not just lip service and see lots of evidence of it over the years. It’s been such a great place to be a part of all this time.

For love of everything dear please do not sell us down this river without some level of protection. I had my family and personal finances set back by a decade by Qwest already once in my life and spent a lot of time getting back to a good place (so should be clear thats my bias here). At a minimum if this is how tw ends negotiate an above average severance for anyone laid off within 1-2 years, or let our options immediately vest or something. They will not be nearly as kind as you have been.

I am a CTH at TW and I am already looking for a new job in light of this news…I agree with your assessment. Morale is on the decline just listening to people chatter this morning.

Relax, its not the end of the world. Its telecom, and if you’ve been doing it more than a couple years, you’ve probably already been through it.

Though I can appreciate the fear: TWTC has long been recognized as a rather stable and progressive, good employer. Can’t remember anyone ever saying that about CL/Q.

It’s unfortunate if one of the few left that give telecom a GOOD reputation were to be gobbled up rather than do some of the gobbling. I suppose good guys finish last….

I can vouch for CL not good for employees. Absolutely spot – on. In their view, the fewer the better. Unless you’re from Louisiana.

As always, if this turns out to be true, the price will be interesting.

$32 per share looks about right. That would represent 9.6x estimated FY ’13 EBITDA ($590 million). Assuming synergies equal 15% of cash costs ($150 in savings) the pro-forma multiple reduces to 7.7x. This is not so dilutive that it can’t be chalked up to the benefit of moving significantly toward a preponderance of growing enterprise and away from retail landline revenue. Certainly the Qwest assets will be enhanced by the metro presence.

The number of consolidation targets will have been significantly reduced– excluding LVLT, this was the biggie.

Isnt it closer to 7k metro route miles and 21k longhaul route miles?

Nope, it’s the other way around. From their last earnings PR: “The Company ended the second quarter with over 28,000 fiber route miles (of which approximately 21,000 were metro miles).” Outside of the west, they have little intercity fiber and lease waves and such IIRC.

Correct. Their strength is in the metro, not between cities. Which is probably why so many of us always surmised they would buy an intercity fiber carrier to help out.

Would you please clarify the character of the “over 28,000 fiber route miles (of which approximately 21,000 were metro miles).” comment above? Does a fiber route mile equal No. of fiber x route miles? In other words, do we need to divide the 21,000 by their average fiber count to get actual route miles of fiber? Seems like 21k divided by 4 fibers is materially different than 21k divided by 144 fibers, if that is the case.

Route Miles vs. Fiber Miles two different animals.

Fiber Route Miles: Fiber Route Miles are measured by the conduit length. A conduit can have 12 – 1024 fiber strands inside it. If you own 2 strands of fiber inside a conduit, you own zero fiber route miles. The owner of the conduit owns the route miles.

Fiber miles: Fiber Miles are measured by taking the number of strands in a fiber conduit and multiplying that number by the route distance of the conduit. For example, a 10 miles of conduit with 144 fiber strands = 1,440 fiber miles.

‘Fiber Route Miles’ = the length

Typically what telcos provide in their 10-k’s/q’s.

‘Fiber Miles’ = route miles x strands

So by looking at their network map and seeing that they are in approximately 100 markets (is that right), one would determine that they might have +200 metro route miles in each market as an avg. (understanding that it does not avg. per market). Is that approximately correct? Do they publish actual metro route miles per market?

thanks.

fiber miles is the least meaningful metric in the telecom infrastructure space.

Route miles are about as relevant to telecom customers/carriers/investors as pedestrians are to airline customers/carriers/investors. They tell you absolutely nothing.

As long as optronics continue evolving, permitting carriers to pack each fiber strand with more and more capacity with smaller energy and equipment budgets per unit of capacity, the less relevant fiber miles become.

At the end of the day, excessive fiber counts merely tempt cash starved carriers to ultimately devalue their (and the industry’s) most precious asset by selling dark fiber IRUs to competitors that will light that fiber to compete directly against you.

I think you meant to start the second paragraph with Fiber miles, not route miles. If so, I completely agree.

Route miles are where an operator goes. Fiber miles are how many places they can stop along the way cheaply. In the metro, fiber miles do matter as it’s much cheaper and easier to hook up buildings along your loops without DWDM/ROADM gear. But it only matters if you’re doing that in bulk (e.g. tw telecom) In the longhaul, fiber count is less relevant once you pass a certain threshold.

rob, that doesn’t make sense. if you want to “hook up a building”, the spur to the new building has to be connected to a lit fiber. Therefore, unlit strands in the cable will sit dormant in that cable until capacity constraints on lit fiber requires it to be turned up or, to my earlier point, is sold as dark fiber to a competitor (or a customer that would otherwise have to buy a lit service).

AnonII, you are correct. Thanks

I stand behind my earlier point, fiber miles are meaningless. Route miles matter.

wouldn’t it depend on the carrier’s fiber layout? if i have a 144F and want to “hook up a building” i will have to splice into my “main fiber” with a smaller fiber. sooner or later if you want to drop fiber(s) off at each building you are going to need pretty significant number of fibers in your “main fiber”

No one has really answered “clarification’s” question yet.

tw Telecom has 21,000 route miles in the metro area and 7,000 route miles in long-haul.

Fair to assume they have significantly more in fiber miles.

too general of a statement in my opinion. I would rather have dense fiber miles in downtown NYC, say 7 micro 144fiber strands, along 25 specific targeted CBD miles (7x144x20) than a 4fiber strand for 250 metro miles (4×250). I also think that makes the “lit building” metric significant, and even more so, the specific type of “lit building”, data center vs. high-rise commercial vs. one-story, etc. As for TWTC, they may have both, who knows for sure?

Level 3 wrote the book on that. And many other blunders but that could be another 10 or so separate threads.

Level 3 may not be ready but they my be placed in a position that says anti up or lose the prize asset of th metro/enterprise space, the very area they are desperate to make inroads and bcome a leader in. This while costly is lightning in a bottle for Level 3 enterprise biz. Fully understanding even if the best is available you do need to show discipline in price, but paying premium vs ridicoulous is two different things

I like the idea of Zayo buying them, but would they want to take on voice? TWT has lot of voice revenue…

It’s enterprise voice, and at a pretty decent scale. I think they’d probably keep it this time if they actually bought it. But honestly I think Caruso and Zayo have better candidates at the moment. Also, they wouldn’t particularly fear tw in the hands of CenturyLink and thus wouldn’t have the impetus to force something with AboveNet to integrate.

If real, this deal is about Cash by end of year

There is no such thing as enterprise voice. All voice in telecom is nothing short of cancer. Not worth doing and not worth supporting. That is unless it is wireless. There is way too much that goes into it for way too little.

Does anyone understand the nuance and laws surrounding disclosure of pending deals when doing a bond offer, loan request, etc? The latest from Time Warner seems to be pointing to their recent bond offers, and CL’s recent start and stop, and saying that “if we were in a deal, we would have had to say so in our recent public statements” – which makes sense. On the other hand, I would assume that if nothing had been officially inked and it was still just a conversation that had gone a long way, they don’t have to say jack about it.

Not enough finance savvy from me to know if that’s the case, but also not sure it sounds plausible. Just gut feel: if you have not signed anything and its still just some conversations in back rooms, you don’t have to tell anyone anything.