Birch Communications apparently found itself a rather large Easter egg over the weekend, announcing the purchase of Cbeyond this morning. It’s an all cash deal worth roughly $323M, with Cbeyond’s shareholders getting between $9.97 and $10.00 per share – a level they certainly haven’t seen in a while.

Cbeyond has been working on a transition from legacy voice and T-1 services to fiber and the cloud, but the hill ahead of them has been a steep one. They had been looking at strategic alternatives for the past couple of quarters, so a sale is not a surprise.

However, this is by a large margin the biggest deal Birch has put on the table. And with 21 acquisitions since 2006 it’s a pretty big table. But the idea of Birch acquiring Cbeyond isn’t totally out of the blue for Ramblings readers, as I had actually posited the idea in an article back in November.

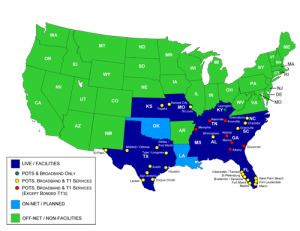

The combination makes a lot of sense from a customer fit and product standpoint, and the assets are starting to build up for Birch. Upon completion of this deal, the combined company will have $700M in annualized revenue, 10,000 fiber route miles, 500 fiber-lit buildings, 570 central office colocations, and 5 data centers. They’ll also have national scope, whereas until now Birch’s focus had been mainly in the southeastern US.

The combination of Birch and Cbeyond creates better scale in geography, network assets, customer breadth, and product portfolio. Or at least it will, once they integrate it all. I expect this one will take a bit more work on the integration front than Birch’s past purchases. Birch’s most recent deals were for the assets of both Lightyear Network Solutions and Ernest Communications in 2013.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: CLEC · Mergers and Acquisitions

A few days prior to the Cbeyond announcement, Birch announced a sales acquisition agreement to acquire substantially all of the wireline customer assets of Selectel Communications Inc., a regional communications provider based in Nebraska. This announcement on April 16th will be the 20th acquisition since 2006.

Cbeyond was the 21st.

And the day after Cbeyond, Birch entered into definitive agreement to acquire substantially all of the customer assets of a portion of the legacy Liberty-Bell Telecom business serving primarily business clients. Liberty-Bell is an affiliate of DISH Network, LLC, a wholly-owned subsidiary of DISH.

On May 1st, Birch announced their 23rd acquisition. A sales acquisition agreement to acquire substantially all of the customer assets of EveryCall Communications, Inc., a competitive local exchange carrier based in Louisiana.

Birch completed the acquisition of CBeyond on Friday, July 18th.

Bad Customer Service buying horrible customer service. Makes sense.., NOT! Banking on Birch removing/replacing all the Cbeyond management from CEO down. Things may improve then. Need honest people in charge.

Customer service in telecom, in general, is typically always ranked at the bottom when you compare it to all other industries. It really does not matter who you work for in this industry, customer service can be challenging to say the least.

It’s great to see that Cbeyond is hopefully getting some better leadership. Birch still has a lot of challenges moving forward, they may need to get a better grip on technology and being a leader in new technology solutions in the industry. Though Cbeyond provides a step towards this solution. The challenge will be whether or not they can sell cloud solutions better than Cbeyond did. Cbeyond had some problems leveraging those cloud assets and taking it to market. As it stands, Birch is a landline/POTs based company in my opinion. They’re buying up rural America, but it’s going take more than that to be successful long term. This industry’s technology evolves quickly.