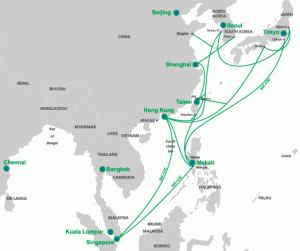

The rumors from last week turned out to be true. Telstra has agreed to acquire Pacnet in a deal worth some $697M, including some $400M in debt. The deal includes both Pacnet’s submarine cables spanning the Asia-Pacific theater and also the company’s joint venture in China.

It’s a combination that makes a lot of sense to me. As it sells off landline assets to NBN in Australia, Telstra’s attention is turning more and more to its global and regional assets. The purchase of Pacnet will give it a complementary set of assets and relationships that further that goal significantly.

It’s a combination that makes a lot of sense to me. As it sells off landline assets to NBN in Australia, Telstra’s attention is turning more and more to its global and regional assets. The purchase of Pacnet will give it a complementary set of assets and relationships that further that goal significantly.

Under the leadership of CEO Carl Grivner, who previously led XO, Pacnet has spent the last two and a half years retooling itself from a wholesale submarine cable operator into a data center and cloud connectivity provider. They’ve gained a significant physical data center foothold in several locations in mainland China as well as licenses to provide IP VPN services there. They have also put together a next generation SDN-powered Ethernet network that Telstra will likely find quite useful in its efforts.

Of course, regulators get to have their say before the deal becomes reality, which is expected in mid-2015. They had $472M in revenues in 2013, on which they earned $111M. That suggests a multiple of about 6.3, assuming we have all the numbers in a consistent form. Telstra has $65M in annual synergies planned.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Ethernet · Mergers and Acquisitions · Undersea cables

Amazing that both euNetworks and Pacnet were taken down without a comment from this board – other than from the curator.

In the case of Pacnet, Telstra Global taking over will bring financial security and greater stability for customers.

Pacnet was operating on a thin budget and sweating the assets for the last few years, selling IRUs to put cash on the balance sheet to keep the wolf away from the door.

The EUNetworks transaction was by the primary existing shareholder and no change of control seemed to occur. That was a housekeeping transaction, de-listing the strange way that EUNetworks was listed, and reducing any need to file information publicly.